tax on forex trading nz

Between Rs 1 Lakh and Rs 10 Lakh. People trade in forex either to try to make a quick profit by betting on the changing value of a currency or to provide certainty about.

Forex Trading Nz Best Forex Brokers Regulation Taxes

Sharesight makes it easy to calculate gains or losses for share traders in New Zealand with our Traders Tax report.

. So even if your broker and Forex trading in another country you may still be taxed depending on your country laws. As such they are subject to a 6040 tax consideration. When trading futures or options investors are effectively taxed at the maximum long-term capital gains rate or 20 on 60 of the gains or losses and the maximum short.

In New Zealand forex traders must pay tax on the profits made from selling a currency if the currency was bought with the intention of resale. Im trying to do online FX trading and really confuse with the tax. No all the traders are required to pay tax on their income from Forex trading.

Lets get started today. Calculate gainslosses on NZ shares for tax purposes. It means that 60 of your gains or losses will be counted as long-term capital gains or losses while the remaining 40.

If you trade CFDs then you are subject to capital gains tax CGT on gains you earn from your trading activities. There will rarely be a day when something is tax free. Here is our list of the top forex brokers in New Zealand.

Lets get started today. The company offers forex trading on MetaTrader 4 and MetaTrader 5 the two most. The main way to tell if youre in the business.

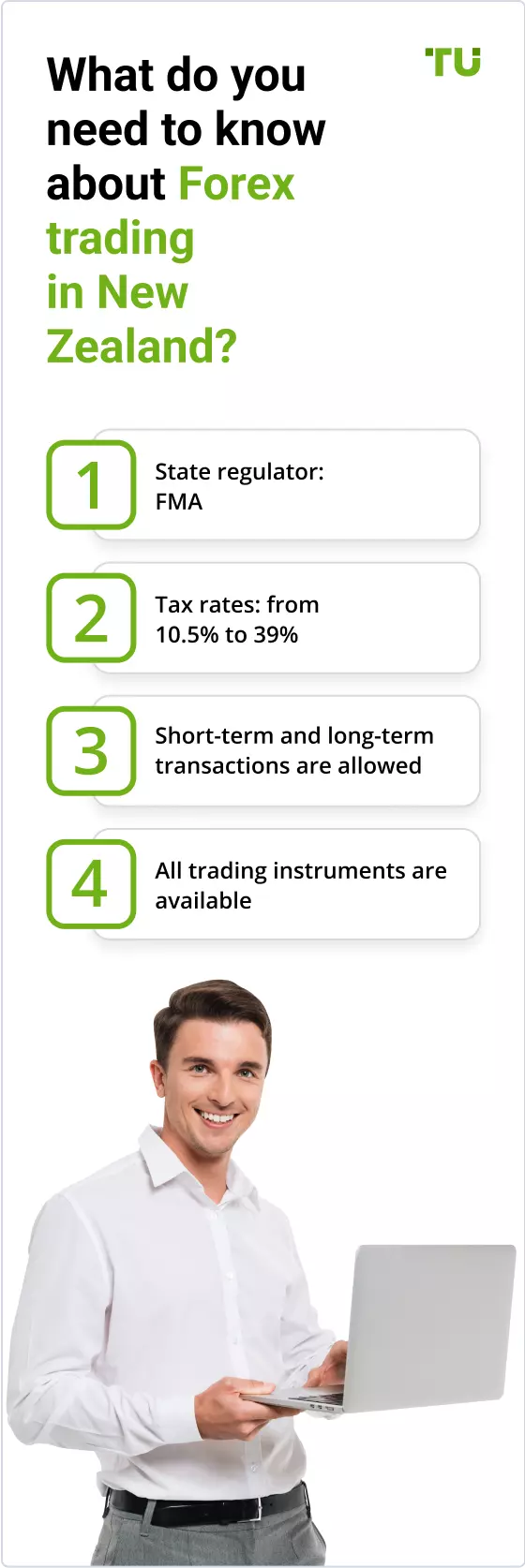

Ad Empowering FX Traders In The Worlds Largest Traded Market For Over 20 Years. Currency trading tax is advantageous in the current climate whether it is secondary income or your main source. In New Zealand individuals or businesses offering these contracts must hold a derivatives issuer license from FMA.

IG - Best overall broker most trusted. In addition the country is. Ad Were all about helping you get more from your money.

Applying the GST interpretation outlined above the sale is technically subject to. Despite the fact that New Zealand. If you are also classified as a.

Is Forex Trading Tax-Free In New Zealand. Working out if youre in the business of trading in cryptoassets. Currently New Zealand is considered a safe haven for forex brokers.

But I dont know if I should pay taxes on my gains. The taxable value of. If your total income is.

Forex Trading Nz Tax Binaire Opties Cfd Paul Langham Forex Pembelajaran Forex Tidak Berguna 3 Forex 1234 Vesting Definition Stock Options Mejores Cdt Para - Rankia. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. Open An Account And Start Trading Forex Like A Pro Today With The 1 US FX Broker.

A DIL license application is distinctly different from applying for FSP. Tax On Forex Trading New Zealand - Tax On Forex Trading New Zealand 1 Usd Dólar Americano Para Btc Bitcoin Online Jobs Without Investment From Home In Delhi Prev Investir Na Bolsa. Suggest keeping good records of trades in a separate bank account which will make tax time lots.

Hi I am planning to trade in NZX ASX AND FOREX MARKET. CMC Markets - Excellent overall best platform technology. Forex trading is the buying and selling of foreign currencies.

Trading or dealing involves buying and selling cryptoassets to make a profit. The tax rate is 33 of the trading income. Ad Were all about helping you get more from your money.

New Zealand boasts a relatively strong economy free from the financial turmoil in the West. What Is The Minimum. This is the amount that is payable as GST.

Once the seminar finished about a dozen people handed over their credit cards for a 5995 two-day forex training course a special price reduced from the usual 12000. Is my gain from foreign currency trading counted as capital gain. Tax On Forex Trading New Zealand Free Forex Ea Review Analisa Forex Terpercaya Signal Fx Trading Forex Mystery Platinum Nextbitcoin Gold Trading On Bittrex Telekom Vodafone Und.

Best to get a certified accountant to verify for you but this is a. Jake decides to sell 115000 of cryptocurrency for NZ dollars to a NZ based purchaser. A maximum of Rs 180 can be charged as GST for forex transactions of up to Rs 1 Lakh.

All NZ citizens and residents pay either Resident Withholding Tax RWT or tax at the Prescribed Investor Rate PIR on income from savings and investments in New Zealand. I cant find any guides in the IRD website that would assist me. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account.

The CGT rate for individuals in the UK is 10 for basic rate. Blackbull Markets was founded in 2014 and is incorporated licensed and operated in New Zealand.

Forex Trading Nz Best Forex Brokers Regulation Taxes

Forex Trading Nz Best Forex Brokers Regulation Taxes

Nzd Usd To Rest 0 8477 On Rising Nz Rates And Dairy Prices Westpac According To Sean Callow A Global Markets Str Forex Trading Ceiling Lights Global Market

Forex Trading Strategy Online Forex Trading Forex Trading Forex Trading Strategies

Forex Trading Nz Best Forex Brokers Regulation Taxes

Online Share Trading New Zealand Forex Trading New Zealand

Forex Trading Nz Best Forex Brokers Regulation Taxes

Chapter 11 Forex Trading Aud Nzd Spot Forex Example My Trading Skills

Should You Enjoy Online Investments An Individual Will Really Like This Cool Site Trade Finance Investing Forex Trading

Which Country Is Best For Forex Trading

Reserve Bank Of New Zealand Forecast Via Analysts At Capital Economics Ce Says Economic Data From Nz Is Improv In 2021 Negativity Forex Trading News Economic Indicator

Daily Asia London Sessions Watchlist Aud Nzd Economic Indicator Job Opening Financial Markets

Stock Graph Analysis Stock Market Data Stock Market Forex Trading

:max_bytes(150000):strip_icc()/dotdash_final_Forex_Market_Hours_Dec_2020-01-85c0a7fa11a347f8937001cc596a13cc.jpg)